Bank statement Revamp

Context

Razorpay capital offers credit products to its users such as Line of credit, corporate credit card & Loans. To apply for credit,

Users must first fill in an online application with their personal & business details.

Then upload their past 6 months bank statements.

Razorpay then evaluates the application & presents an offer.

We noticed that the bank statement upload process had a significant drop-off rate of ~50%. It became crucial to understand the reasons behind this high drop-off and implement solutions to address them.

Timeline

2 Weeks

Team

1x Product designer (Me)

1x Product Manager

1x Front end engineer

1x Back end engineer

Impact

Current Journey

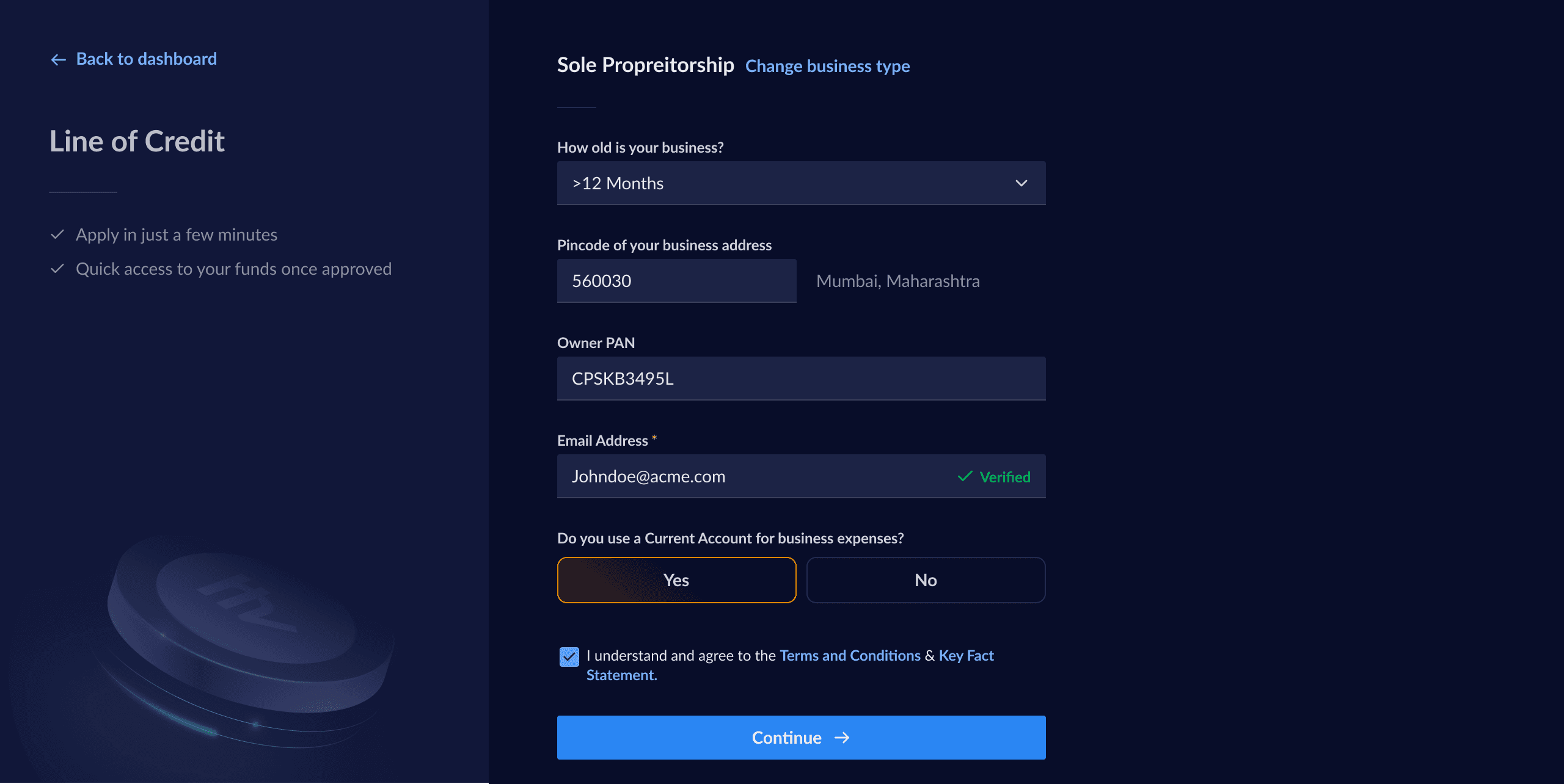

Step 1: Enter personal details

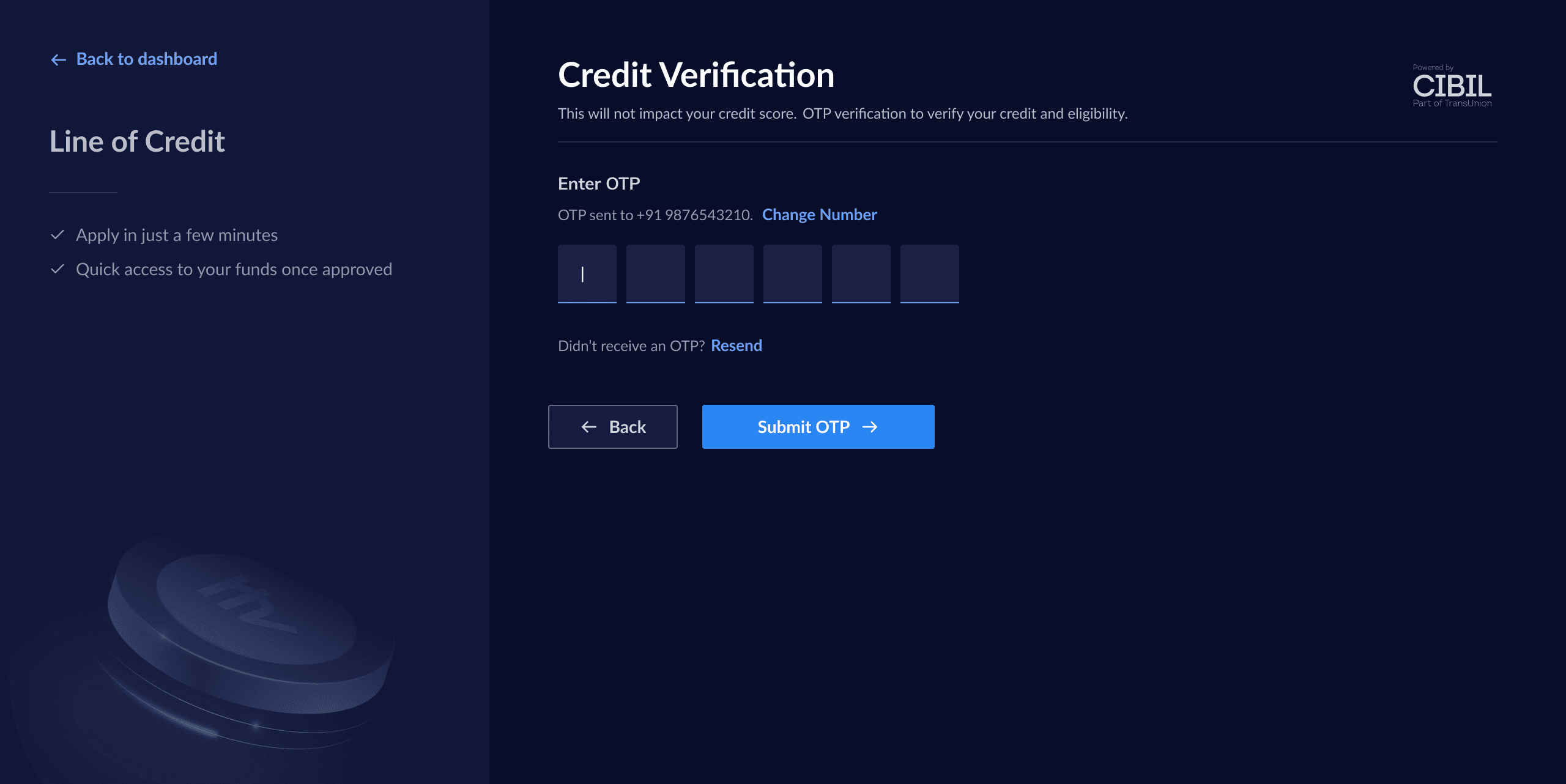

Step 2: Credit verification

Step 3: Bank statement upload

Step 4: Business details

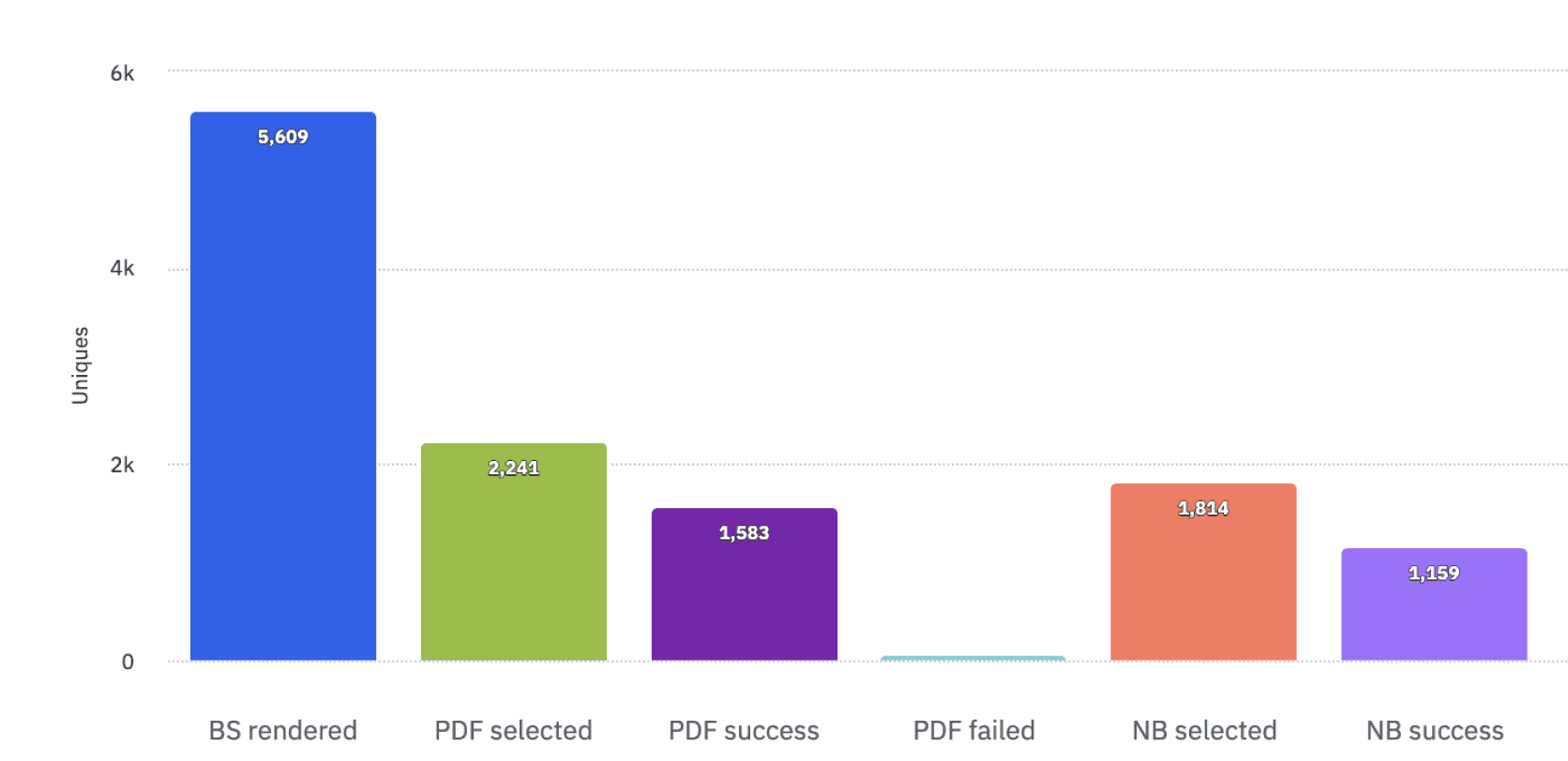

Let’s look at the funnel for the above steps

Personal details

X

Credit Score

0.8 X

Bank statement upload

0.7 X

Business details

0.3 X

We observed a ~50% drop-off from the bank statement collection step to the next. It was crucial to investigate whether this drop was due to process issues or user experience challenges.

The Process

Input 1: Bank statement Funnel

Input 2

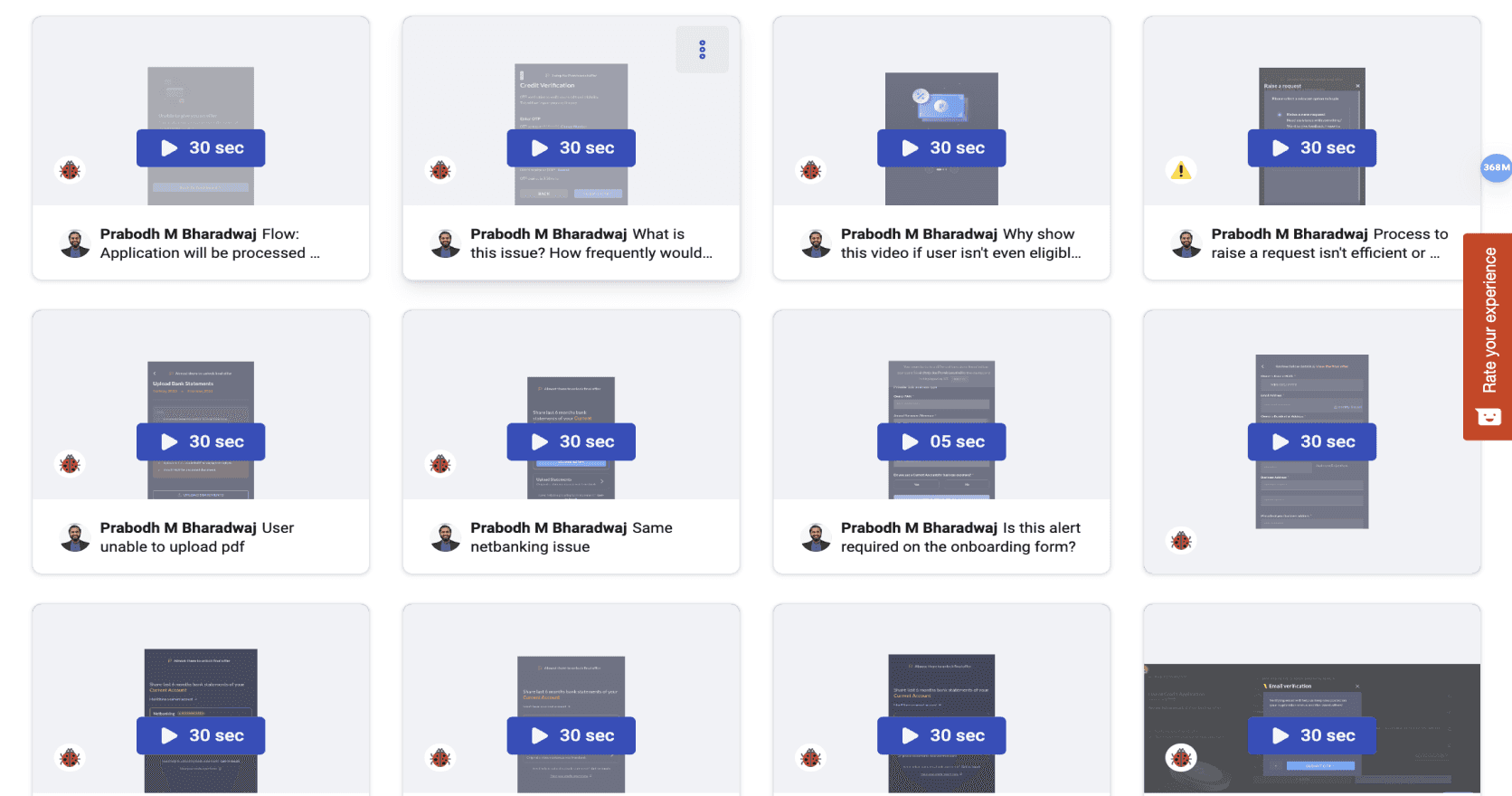

Hotjar session recordings

Input 3

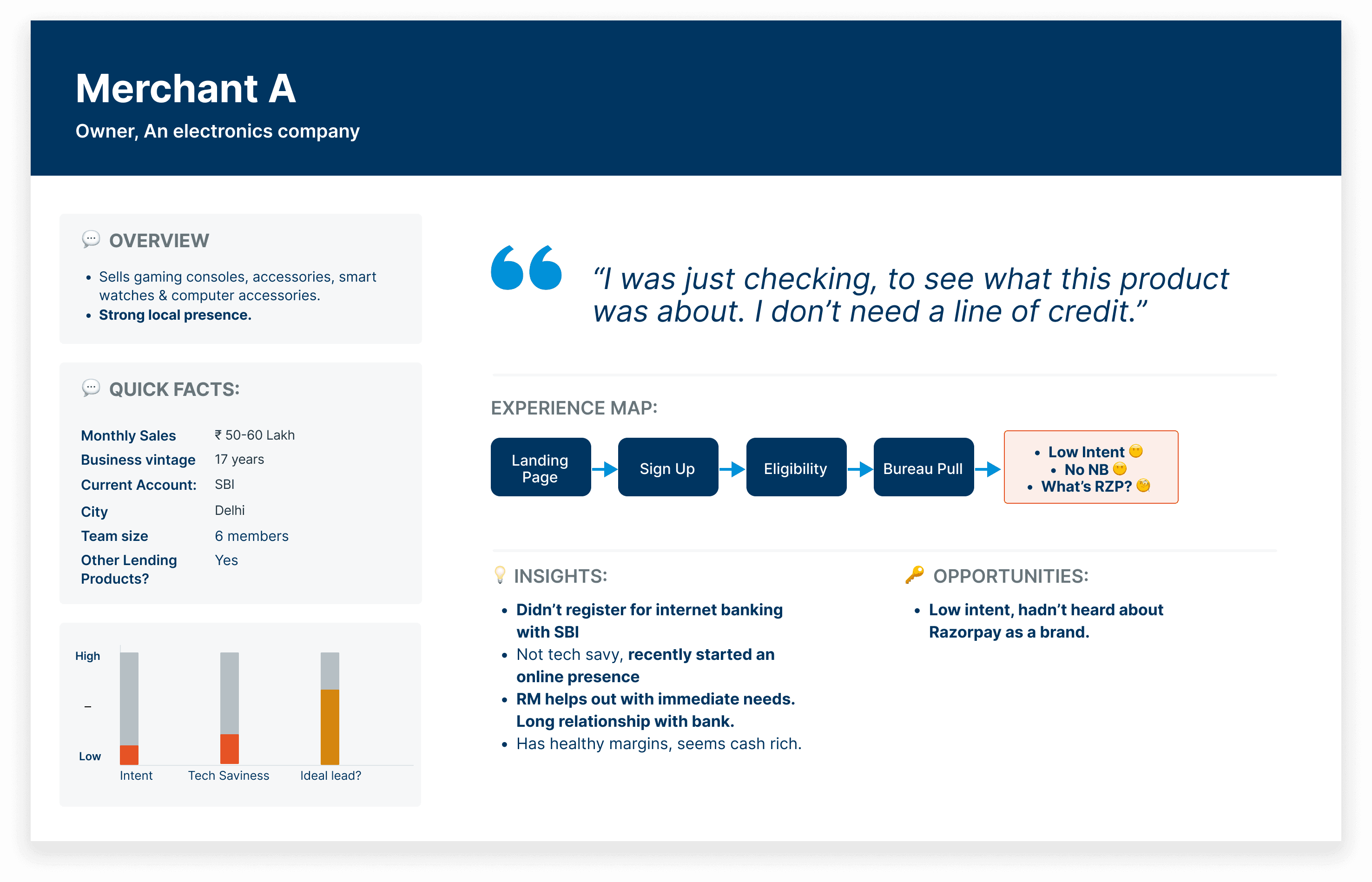

User calls

Input 4

Conversations with Sales & Ops teams

Insights

Insight 1

Conversation with Sales & Ops teams

Delayed feedback on bank statement is causing high TAT & a low self serve rate

As the process was manual, it took over two days to provide users with feedback and next steps.

How Might We

Bring down time to share feedback with users?

Enable sales & ops teams to be more efficient?

Insight 2

Hotjar session recordings

Unknown bugs were preventing users from using netbanking

The netbanking screens wouldn’t load on click or would return a failed message without any further action.

How Might We

Identify bugs in the process sooner?

Insight 3

User calls

Users were skeptical about the netbanking upload process

Users were unaware of the third party we had integrated with for bank statement collection.

How Might We

Build trust with the users?

Communicate that their data is secure and protected?

Insight 4

User calls

The specifics of PDF upload were unclear to the users.

It was difficult for users to decode the requirements from the UI.

How Might We

Build trust with the users?

Communicate that their data is secure and protected?

Insight 5

User calls

Corporate net banking was unavailable on the 3rd party site.

How Might We

Identify process gaps sooner?

Design Solution

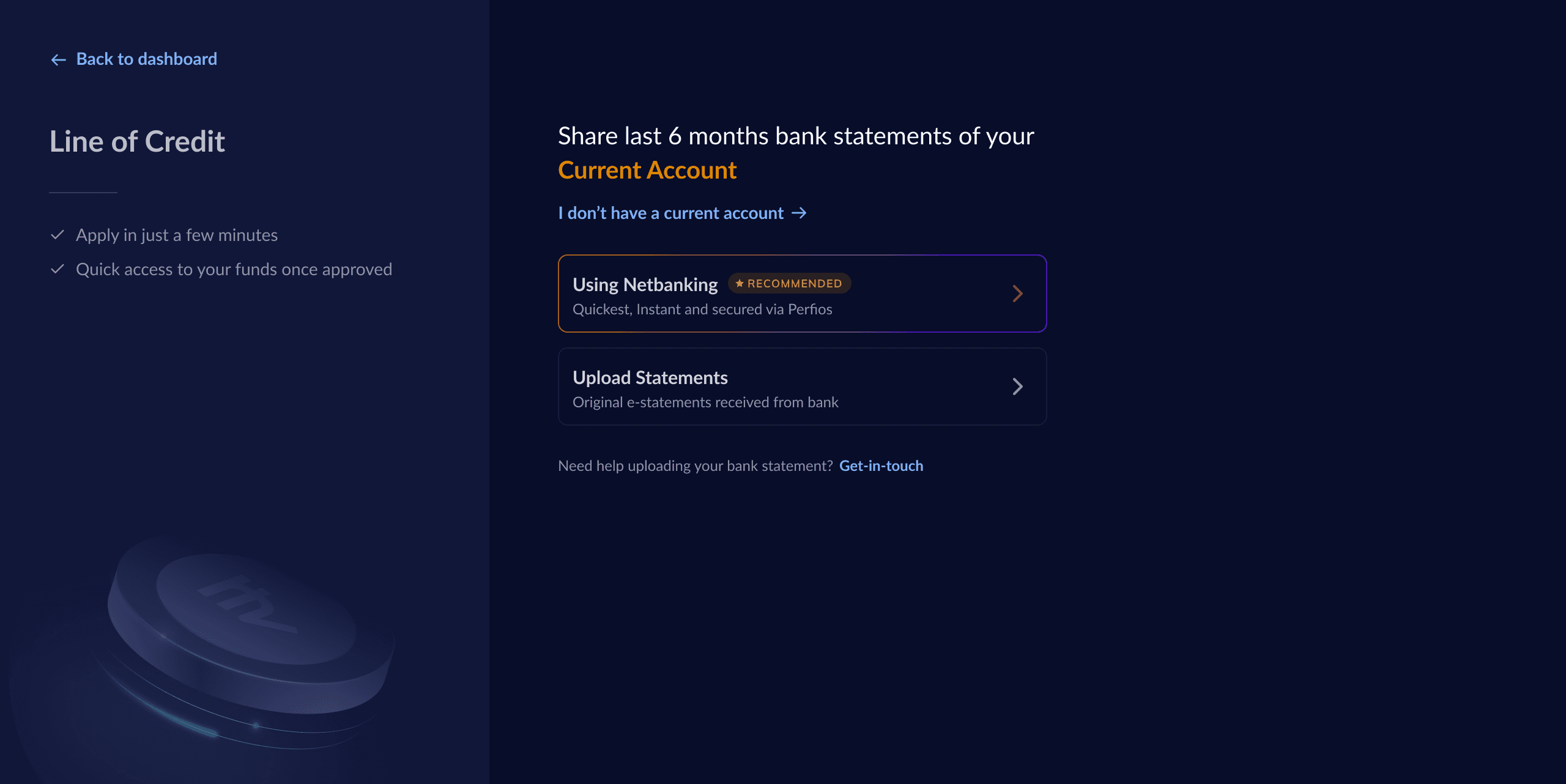

Simplify the bank statement upload screens

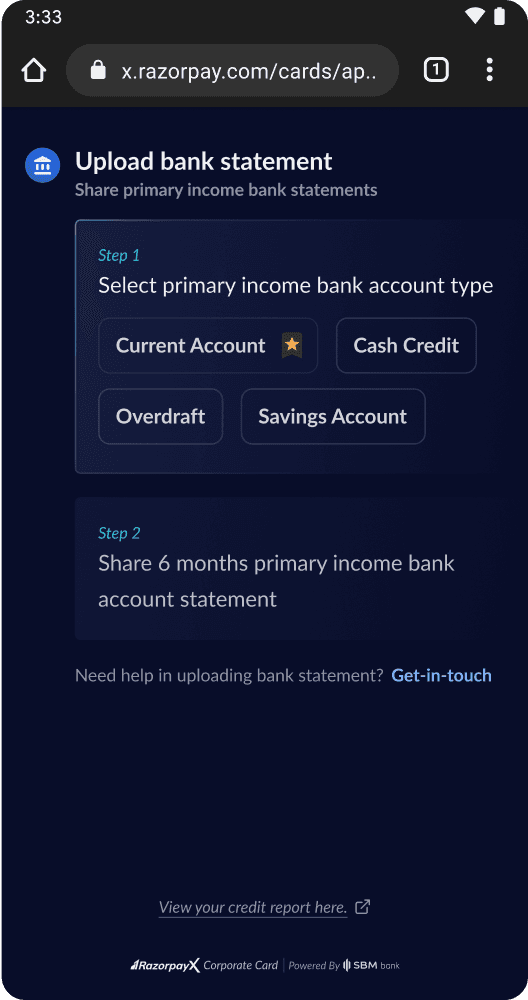

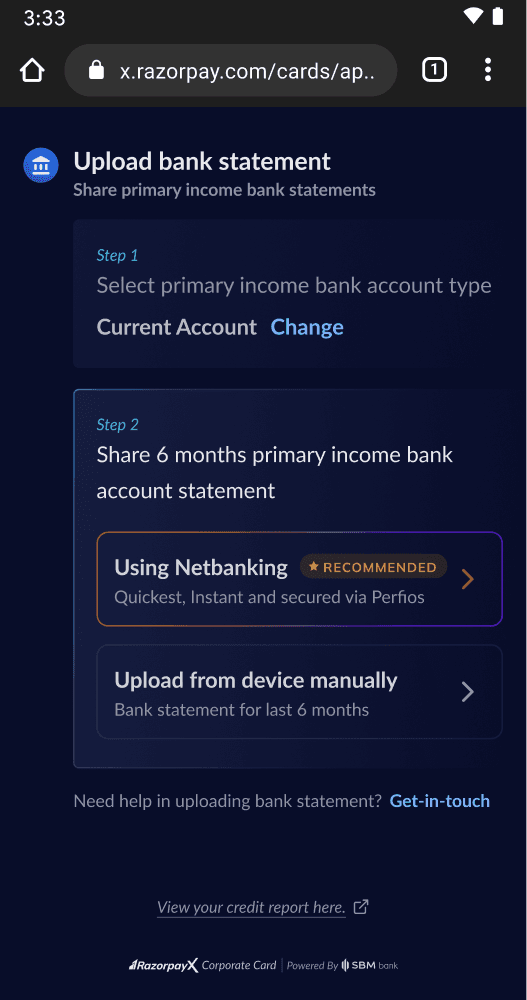

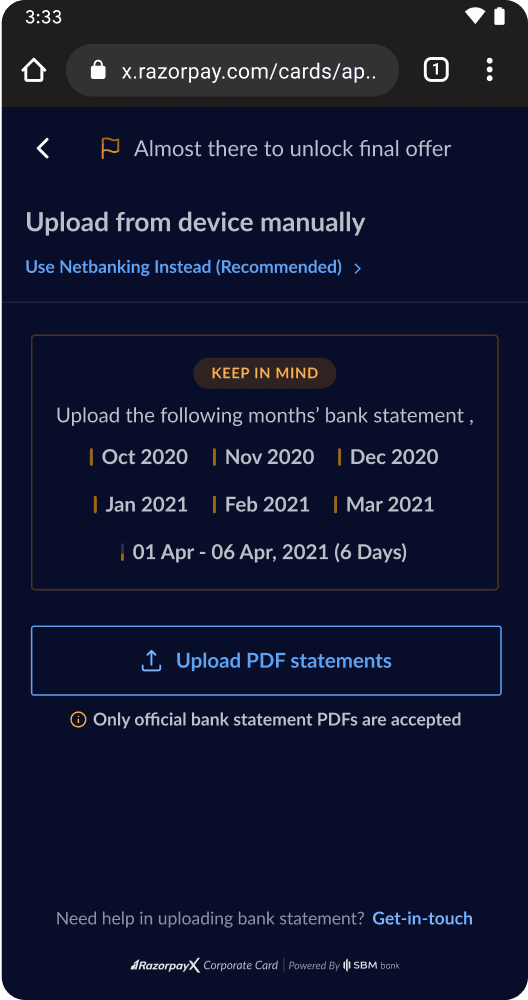

Previous Designs

Select account type

Select method

Previously, users had to complete a two-step process to select their account type and method.

Although we would only accept ‘Current account' types’ we displayed 4 options to the users.

Overall we found the UI to be crammed & not simple enough for users to understand easily.

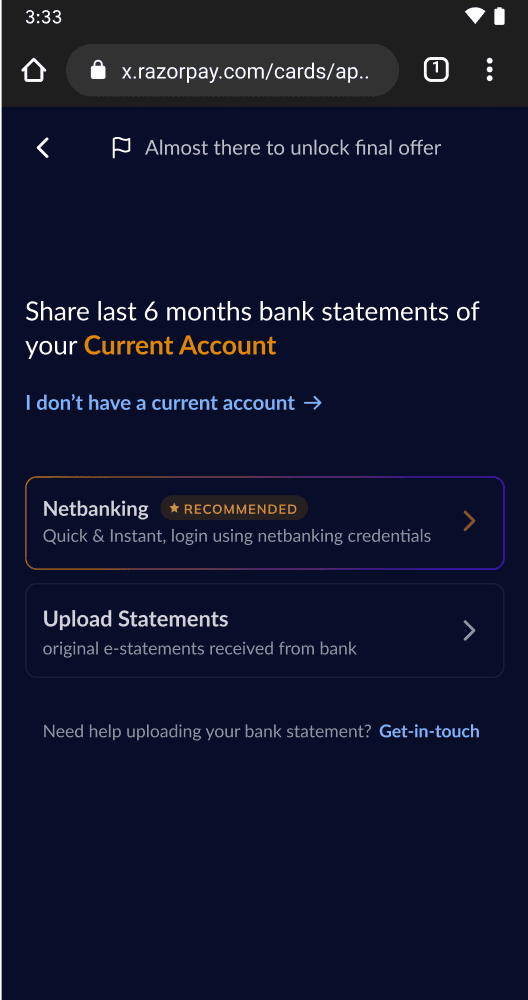

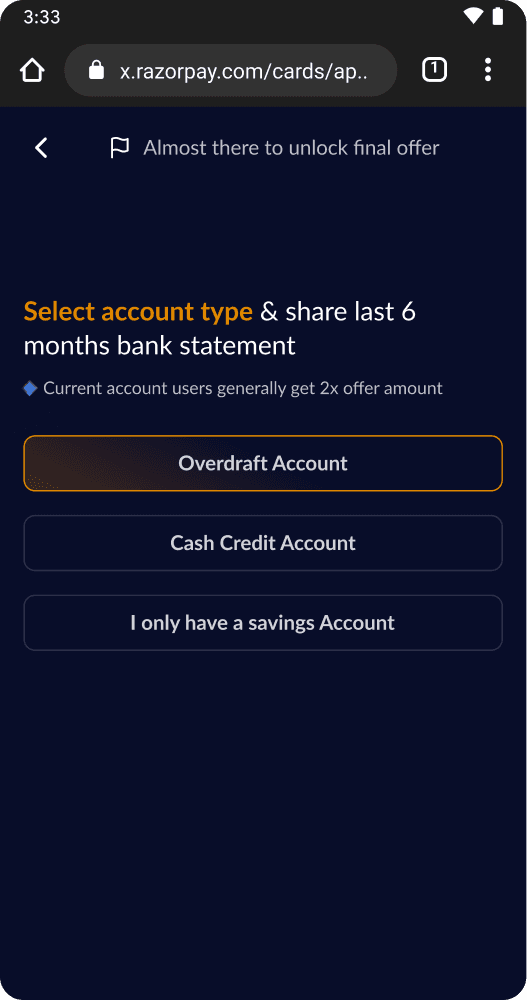

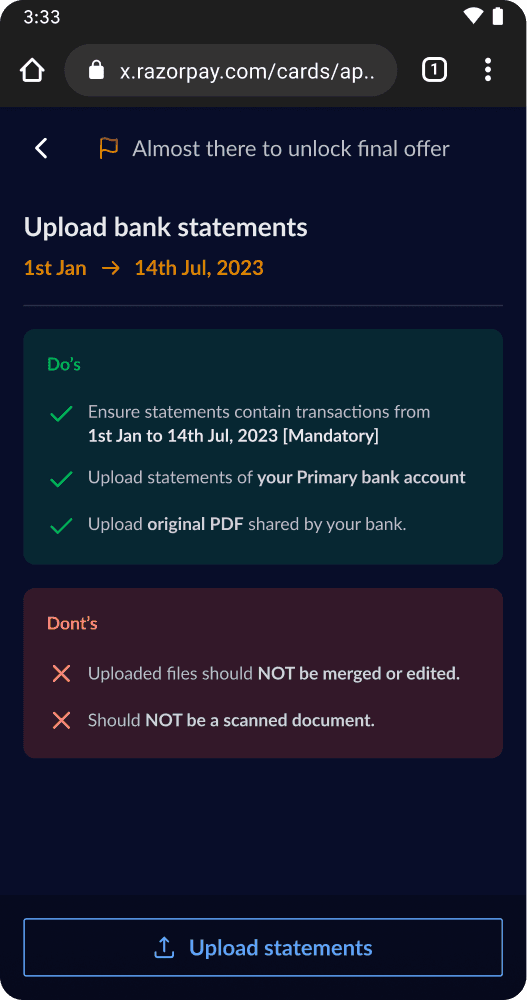

New Designs

Upload statements of current account

Select another account type

With the new designs, I focused on simplifying the screen to primarily request only the accepted bank account type, while providing an option for users to select alternatives if needed.

Clear & concise communication on what is required

Previous Designs

Upload statements of current account

New Designs

Select another account type

Although the previous designs highlighted the requirements, they lacked proper structure and clarity regarding the do's and don'ts for users

In the redesign, I clearly specified the dates for the required statements along with the do's and don'ts.

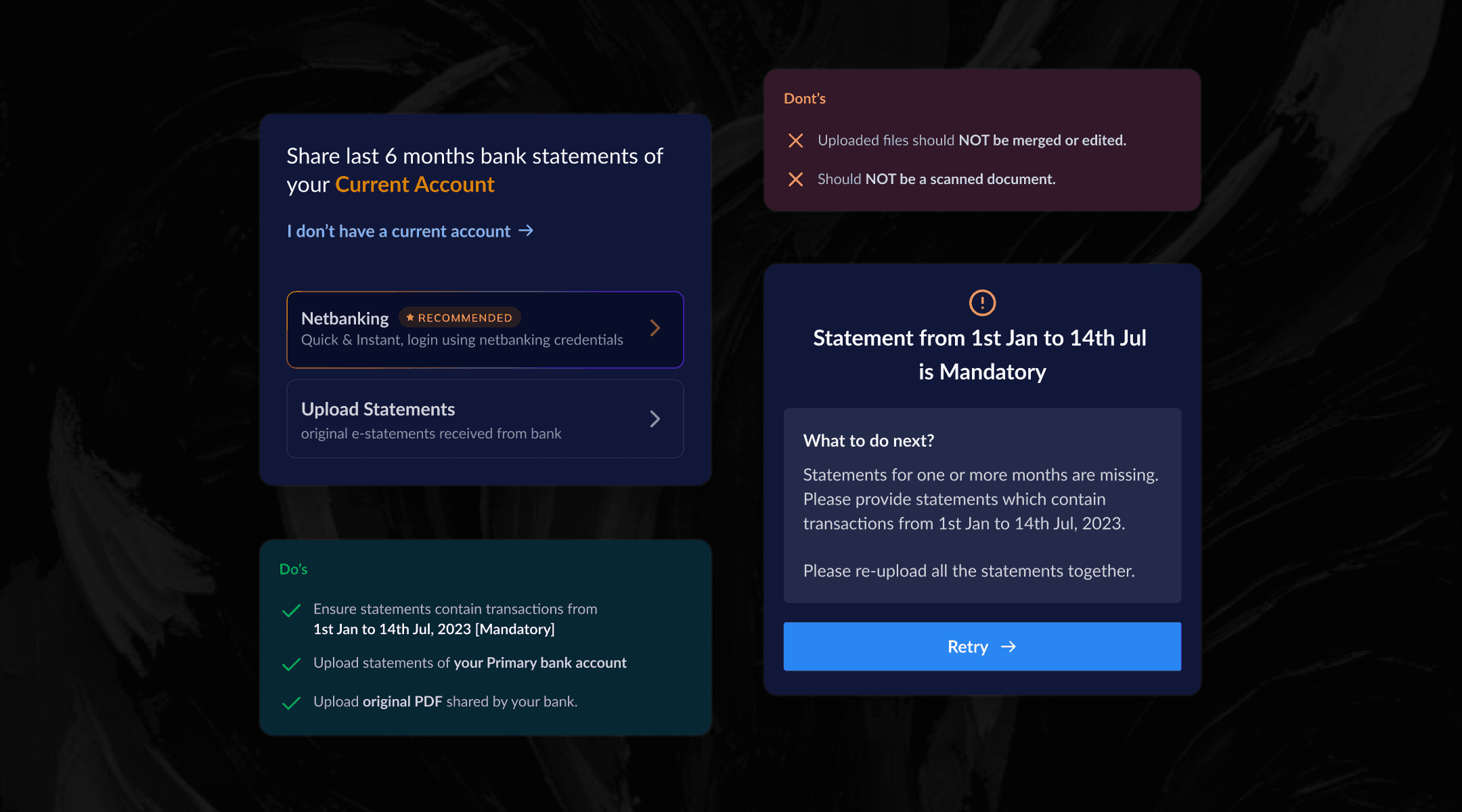

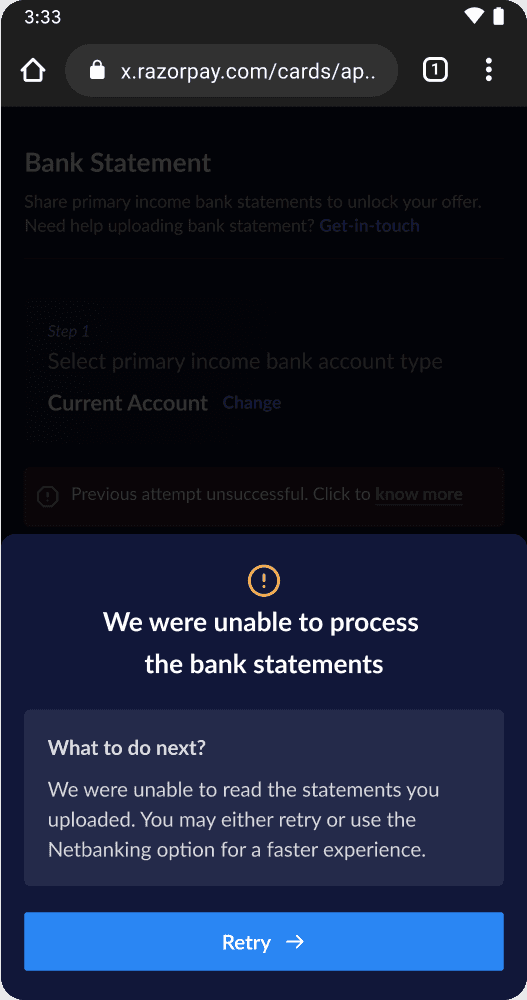

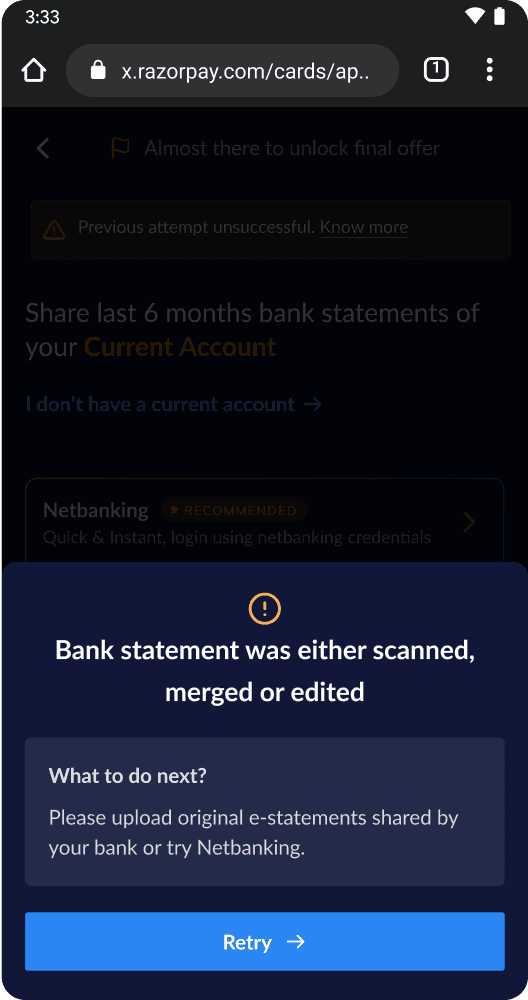

Realtime feedback on the uploaded bank statements

Generic error

PDF upload error

With the help of the backend engineer, we identified the various error codes that could arise during bank statement processing and mapped them to appropriate messages for the dashboard.

What once took 2-3 days to communicate feedback now only takes 30 seconds to process statements and inform users of any issues. This allows users to correct and re-upload their statements quickly.

Impact